Achieve your financial potential

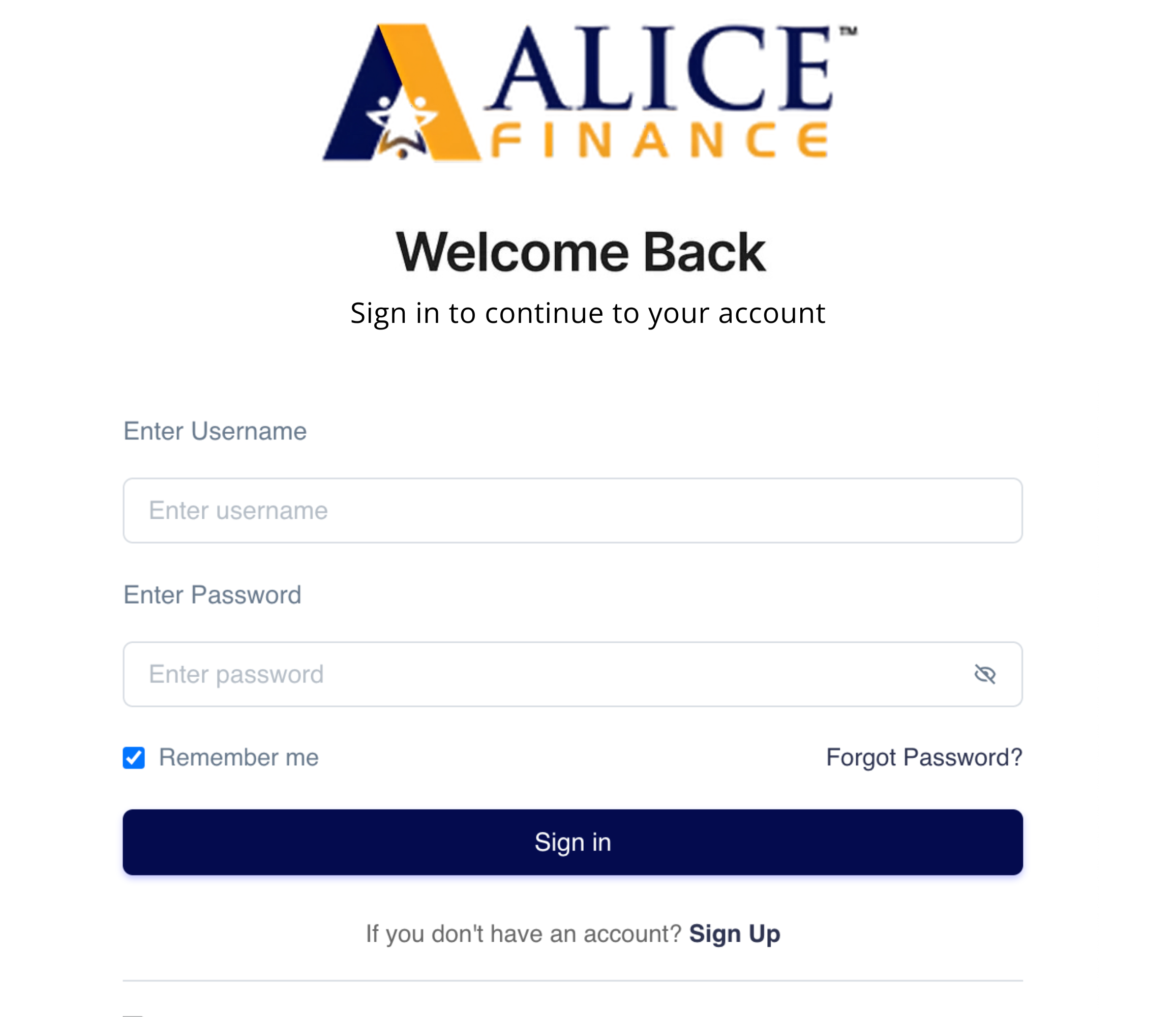

Join the Alice finance

Join the Alice finance

family Now!

and we will help you get eligible for financial services.

like loans,insurances,credits cards.